Loan & Asset Management

Providing an optimal experience for your clients

Q-Lana: A powerful & flexible Loan Management system

Q-Lana simplifies loan management by helping financial institutions streamline workflows, enhance risk management, and improve customer experiences. Built on a low-code platform, Q-Lana integrates seamlessly with existing systems and adapts to evolving business needs, ensuring long-term efficiency and scalability.

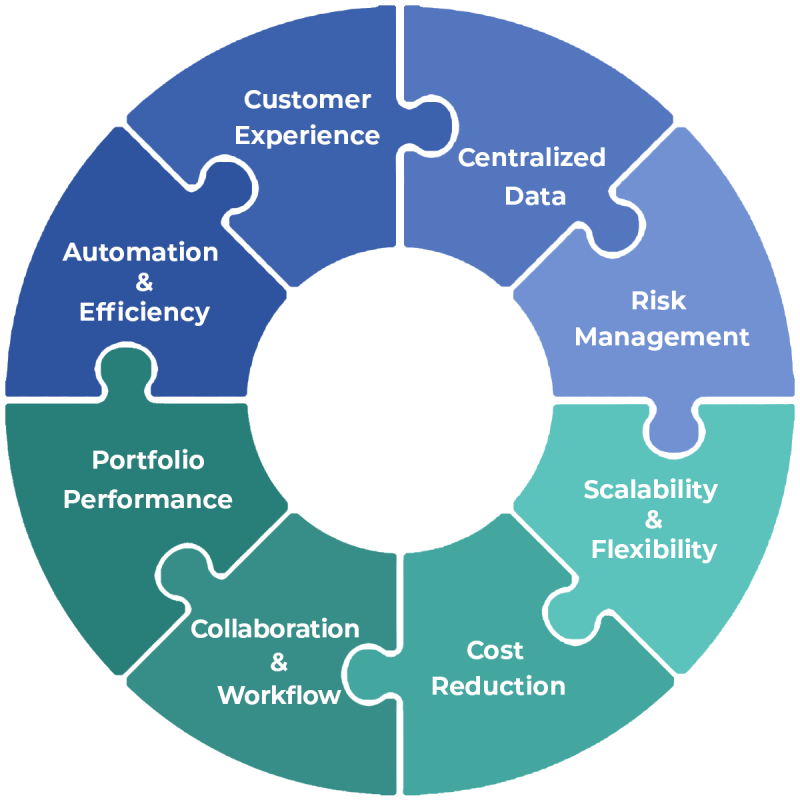

Key benefits of Q-Lana

- Automation and Efficiency: Automates loan processes, including origination, disbursement, monitoring, and reporting, reducing manual tasks and minimizing errors.

- Enhanced Customer Experience: Delivers a seamless multichannel loan application process with real-time status updates, improving client relationships and fostering trust.

- Improved Risk Management: Incorporates advanced risk assessment models and early warning systems, helping institutions make more informed lending decisions and manage exposures effectively.

- Centralized Data and Reporting: Consolidates qualitative and quantitative client data in a centralized system, providing real-time insights and improving decision-making.

- Cost Reduction: Streamlines processes to reduce administrative costs, allowing institutions to reinvest savings into strengthening client relationships.

- Scalability and Flexibility: Supports various loan types and adapts to changing business needs with a future-proof, low-code platform.

- Collaboration and Workflow Management: Enhances collaboration across teams and with external service providers, replicating comprehensive workflows and standardizing best practices.

- Optimizing Portfolio Performance: Tracks loan performance metrics, mitigates risk, and identifies inefficiencies to boost profitability.

Review every phase of the lending process to learn about Q-Lana’s key features

Stay updated on industry knowledge and solutions from Q-Lana.

Join our mailing list to receive our monthly newsletter.