A major challenge in the risk assessment of SME borrowers is the largely unstructured and of qualitative nature of information. Financial Institutions find it difficult to approach the assessment this information which often includes only rudimentary and un-audited financial statements. Mass market retail loans are easier to evaluate because of the larger share of quantifiable information which can serve as a better input for a quantitative scoring module.

Don’t underestimate the importance of monitoring of SME loans!

We see a fundamental difference in the focus of assessment and monitoring of retail/microfinance loans versus larger SME loans. A retail loan approval can be compared to a bet on the client’s ability and willingness to repay the loan, based on the best possible information. The performance of an SME loan can be influenced through active monitoring and guidance of the borrower over the lifespan of the loan.

For this reason, we consider providing financial services to SMEs as one of the more interesting and challenging business areas for financial institutions. SME clients require specific understanding of their way to conduct business, the entrepreneur’s personality, strengths and weaknesses. We have developed several tools within Q-Lana that help dealing with this specific nature of information and supporting banks to assess the information better. In the following, we will explain a few of them.

Networking

SMEs operate within the business community of a country/region. A close tie with other companies is very common, as entrepreneurs know and trust each other, and employees move between companies of the same sector. Often there are close business ties with suppliers or exporters. It is also typical for entrepreneurs in developing countries to own a conglomerate of companies across different sectors, managed by family members. For the analysis of risk, identification of early warning signals and crisis management in case of a payment default, the knowledge of those ties is important. Q-Lana allows to link companies and individuals based on several criteria, including: family relationships, company ownership, employment, supplier or customer relationship.

Through building those relationships on the Q-Lana platform, it becomes easier to understand the risk relationships. Such an understanding helps the Financial Institution in the monitoring. Critical exposures can be placed on a watch list which requires a closer monitoring until the nature of the risk is assessed. For example, in the case of delivery problems of a supplier, the Financial Institution can assess immediately which other borrowers are affected or can recommend alternative suppliers. In case of financial difficulties of a client, the risk profile of its employees, related companies or business partners can be assessed. Q-Lana makes such analysis easy to execute

Start Rating of Qualitative Information

The Q-Lana platform is set up to facilitate the qualitative monitoring of clients and exposures. The monitoring happens largely through interaction with clients. A post disbursement visit and the quarterly/annually review our scheduled ways of monitoring activities. In addition, there can be ad hoc visits of the client’s facilities or other observations, resulting for example from communication with other clients. Q-Lana allows to track all those observations in structured visit/observation reports. Each report can be classified with five-star grading. An observation rated with five stars represents very positive news for the client. While each observation is subjective, the accumulation of observations within the institution will create objectivity. The financial institution can analyze the grading trends for all observations across the portfolio, sectors, and individual clients. This trend analysis helps the financial institution to identify specific trends early on.

Rating Tools

Rating tools are another way to summarize the assessment of client observations. As explained in the third blog entry, Q-Lana has a rating widget which can be applied at several stages of the lending process, including the pre-disbursement assessment as well as the post disbursement early warning monitoring. The rating methodology can be based on statistical as well as heuristic concepts. When developing Q-Lana we recognize that the calibration of such models will always happen in a separate exercise, as most institution like the necessary number of transactions, to apply technologies such as machine learning.

Active Monitoring

To facilitate the active monitoring of exposures, Q-Lana provides a number derived from Customer Relationship Management. At any stage, the user can add tasks with specific deadlines for other employees as well as himself, as reminders about follow-ups with clients, deadlines, maturity dates of collateral and other purposes. Those tasks can be tracked on the user’s front page (Dashboard). Q-Lana also integrates social media feeds. In case the client actively maintains a presence on social media sites such as LinkedIn, Facebook, or Twitter, updates are fed into the touch point trigger.

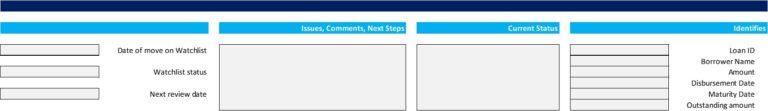

Watch List

In many countries, regulatory authorities define a classification for loans, in which the first category of risky loans are defined as “watch”. Q-Lana expands the expression of a watch list to clients which are still performing but show early warning signals of risk. For any financial institution, the riskiest clients are not those which are 30 or more days in areas, but those which are still performing today, yet are at risk to miss a payment in the future. Clients in arrears are certainly problem loans, but there is reduced uncertainty about the credit quality, since they already failed on a payment. Q-Lana’s watchlist is a simple methodology to identify risky exposures and place them on a list. Consequently, the relationship manager is required to comment on the riskiness of the exposure, implement ways to mitigate the risk, or define the risk as minor. Clients remain on the watchlist, until solutions are found for the mitigation of risk.

Risk Advisory

Q-Lana is also preparing the launching of a Risk Advisory function. This will consist of a team of in-house experts and consultants who support the client financial institutions in the assessment of the risk profile, improvement of the risk management process, and implementation of solutions for specific risk situation. Any client of Q-Lana can sign up for the services of the Risk Advisory and can receive support in a defined manner. One of the benefits of such a risk advisory is the ability to share information about trends. A financial institution which is prepared to share certain performance information of its portfolio (within the framework of protection of confidentiality), will receive aggregated industry information about the risk trends, performance issues and other observations made across the universe of Q-Lana clients.

Each of the tools presented in this text provides a unique and if it for the financial institution in the process of managing the credit risk of its loan portfolio. Client of Q-Lana can use those tools at their discretion. We also expect to develop additional tools and methodologies as we are collecting information from the financial institutions.